SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant

x☒

Filed by a party other than the Registrant

¨☐

Check the appropriate box:

| | | | | |

x | ☒ | Preliminary Proxy Statement |

¨☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨ | ☐ | Definitive Proxy Statement |

¨ | ☐ | Definitive Additional Materials |

¨ | ☐ | Soliciting Material under § 240.14a-12 |

MITEK SYSTEMS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

MITEK SYSTEMS, INC. | | | | | | | | | | | | | | |

(Name of Registrant as Specified in Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

x☒ | | No fee required. |

¨☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | | Title of each class of securities to which transaction applies: |

| | | (2) | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | |

| | (5) | | Total fee paid: |

| ☐ | | | |

| | | | |

¨ | | Fee paid previously with preliminary materials. |

¨☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | | |

| | | (2) | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | | Filing Party: |

| | (3) | | Filing Party:

|

| | | | |

| | (4) | | Date Filed:

|

| | | | Date Filed: |

MITEK SYSTEMS, INC.

8911 BALBOA AVE.,

SAN DIEGO, CALIFORNIA

9212392101

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

FEBRUARY 13, 2013MARCH 2, 2022

TO THE STOCKHOLDERS OF MITEK SYSTEMS, INC.

The annual meeting of stockholders of Mitek Systems, Inc., will be held at 9:00 a.m., local time, on Wednesday, February 13, 2013,March 2, 2022, at the offices of Paul Hastings LLP, 4747 Executive Drive,Mitek Systems, Inc. 600 B. Street. Suite 100, San Diego, California 92121,92101, for the following purposes: | 1. | | | | | | | |

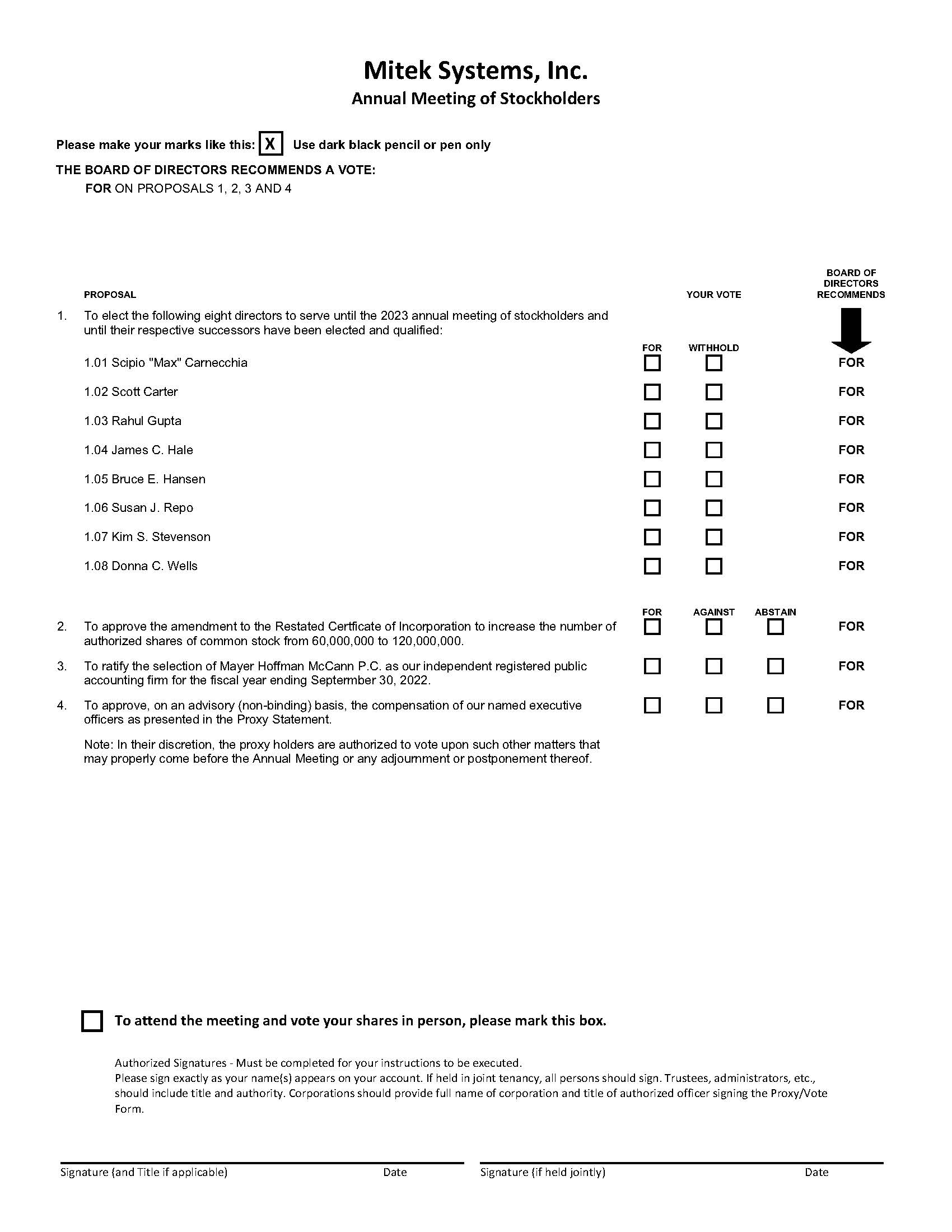

| 1 | . | | To elect the following seveneight directors to serve until our 20142023 annual meeting of stockholders and until their respective successors have been elected and qualified: John M. Thornton,Scipio “Max” Carnecchia, Scott Carter, Rahul Gupta, James B. DeBello, Vinton P. Cunningham, Gerald I. Farmer,C. Hale, Bruce E. Hansen, Alex W. “Pete” HartSusan Repo, Kimberly S. Stevenson, and Sally B. Thornton;Donna C. Wells; |

| 2. | |

| 2 | . | | To approve anthe amendment to our restated certificatethe Restated Certificate of incorporationIncorporation to increase the number of authorized shares of common stock from 40,000,00060,000,000 to 60,000,000;120,000,000; |

| 3. | |

| 3 | . | | To ratify the selection of Mayer Hoffman McCann P.C. as our independent registered public accounting firm for the fiscal year ending September 30, 2013;2022; |

| | |

| 4 | . | | To approve, on an advisory (non-binding) basis, the compensation of our named executive officers as presented in the Proxy Statement accompanying this notice; and |

| 4. | |

| 5 | . | | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the Proxy Statement accompanying this notice.

Our Board of Directors has fixed the close of business on January 3, 201312, 2022 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting and all adjournments or postponements thereof. A list of these stockholders will be open to examination by any stockholder at the annual meeting and for ten days prior thereto during normal business hours at our executive offices located at 8911 Balboa Ave.,600 B Street, Suite B,100, San Diego, California 92123.92101. Enclosed for your convenience is a proxy card which may be used to vote your shares at the annual meeting. The proxy materials, including a proxy card and our Annual Report on Form 10-K for the fiscal year ended September 30, 2012,2021, are available online atwww.proxyvote.comwww.proxydocs.com/MITK. You are invited to attend the annual meeting in person. Even if you expect to attend the annual meeting, it is important that you complete, sign, date and return the enclosed proxy card as promptly as possible in the enclosed return envelope (which is postage prepaid if mailed in the United States) in order to ensure that your shares are represented at the annual meeting. Even if you have voted by proxy, you may still revoke such proxy and vote in person if you attend the annual meeting. However, please note that if your shares are held of record by a broker, bank or other agent and you wish to vote at the annual meeting, you must obtain a proxy card issued in your name from such record holder.

| | | | | | | | |

| | By Order of the Board of Directors |

| | |

| San Diego, California | | Scipio “Max” Carnecchia |

| January 14, 2022 | | Chief Executive Officer |

TABLE OF CONTENTS

| | | | | | | | |

| |  |

San Diego, California

January 4, 2013

| | John M. Thornton

Chairman of the Board

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

MITEK SYSTEMS, INC.

8911 BALBOA AVE.,

SAN DIEGO, CALIFORNIA

9212392101

FOR THE

20132022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

FEBRUARY 13, 2013MARCH 2, 2022

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement (the“Proxy Statement”) and the enclosed proxy card because the Board of Directors (the“Board”) of Mitek Systems, Inc. (sometimes referred to as“we”,“us”,“our”,“Mitek” or the“Company”) is soliciting your proxy to vote at our 20132022 annual meeting of stockholders, or any adjournment or postponement thereof (the“Annual Meeting”). You are invited to attend the Annual Meeting and we request that you vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign, date and return the enclosed proxy card or submit your proxy through the Internet or by telephone according to the instructions contained in the enclosed proxy card. We intend to mail this Proxy Statement and the accompanying materials to all stockholders of record entitled to vote at the Annual Meeting on or about January

18, 2013.31, 2022.

When and where will the Annual Meeting be held?

The Annual Meeting will be held at 9:00 a.m., local time, on Wednesday,

February 13, 2013,March 2, 2022, at

the offices of Paul Hastings LLP, 4747 Executive Drive,Mitek Systems, Inc. 600 B. Street. Suite 100, San Diego, California

92121.92101.

Who can vote at the Annual Meeting and how many votes do I have?

Only stockholders of record at the close of business on January

3, 201312, 2022 will be entitled to vote at the Annual Meeting. At the close of business on this record date, there were

26,041,28344,235,734 shares of common stock outstanding and entitled to vote. With respect to each proposal to be voted upon at the Annual Meeting, you are entitled to one vote for each share of common stock held as of the record date.

Stockholder of Record: Shares Registered in Your Name

If at the close of business on January

3, 201312, 2022, your shares of common stock were registered directly in your name with our transfer agent, Computershare

Trust Company, NA, then you are the stockholder of record of these shares. As a stockholder of record, you may vote either in person at the Annual Meeting or by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to complete, sign, date and return the enclosed proxy card or submit your proxy through the Internet or by telephone by following the instructions provided in the enclosed proxy card to ensure that your vote is counted.

Beneficial Owner: Shares Registered in the Name of Your Broker, Bank or Other Agent

If at the close of business on January

3, 201312, 2022 your shares of common stock were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker, bank or other agent regarding how to

-1-

vote the shares in your account. Certain of these institutions offer the ability to direct your agent how to vote through the Internet or by telephone. You are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy card issued in your name from your broker, bank or other agent in whose name the shares are registered prior to the Annual Meeting.

There are

threefour matters scheduled for a vote at the Annual Meeting:

•Election of the seveneight nominees for director named in this Proxy Statement to serve until our 20142023 annual meeting of stockholders and until their respective successors have been elected and qualified;

•To approve the amendment to our restated certificatethe Restated Certificate of incorporationIncorporation to increase the number of authorized shares of common stock from 40,000,00060,000,000 to 60,000,000; and120,000,000;

•Ratification of the selection of Mayer Hoffman McCann P.C. (“Mayer Hoffman”) as our independent registered public accounting firm for the fiscal year ending September 30, 2013.2022; and

•Approval, on an advisory (non-binding) basis, of the compensation paid to our named executive officers as presented in this Proxy Statement.

Will there be any other items of business on the agenda?

Other than the election of directors,

approval of anthe amendment to our

restated certificateRestated Certificate of

incorporation andIncorporation, the ratification of the selection of Mayer Hoffman as our independent registered public accounting firm,

and the advisory vote on the compensation of our named executive officers, the Board knows of no other matters to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote may properly be taken, shares represented by all proxies received by the Board will be voted with respect to such matter in accordance with the judgment of the persons named as attorneys-in-fact in the proxies.

What is the Board’s voting recommendation?

The Board recommends that you vote your shares:

•“For” each of the seveneight nominees for director named in this Proxy Statement;

•“For” the approval of anthe amendment to our restated certificatethe Restated Certificate of incorporationIncorporation to increase the number of authorized shares of common stock from 40,000,00060,000,000 to 60,000,000; and

120,000,000;•“For” the ratification of the selection of Mayer Hoffman as our independent registered public accounting firm for the fiscal year ending September 30, 2013.

2022; and•“For” the approval, on an advisory (non-binding) basis, of the compensation paid to our named executive officers as presented in this Proxy Statement.

With respect to the election of directors, you may either vote “for” any or all of the nominees proposed by the Board or you may “withhold” your vote for any or all of the nominees. For each of the other matters to be voted on, you may vote “for” or “against” or abstain from voting. The procedures for voting are described below, based upon the form of ownership of your shares.

Stockholder of Record: Shares Registered in Your Name

If you do not wish to vote in person or you will not be attending the Annual Meeting, you may vote by proxy. You may vote by proxy using the enclosed proxy card, vote by proxy through the Internet or vote by proxy over the telephone. The procedures for voting by proxy are as follows:

•To vote by proxy using the enclosed proxy card, complete, sign and date your proxy card and return it promptly in the envelope provided.

-2-

•To vote by proxy through the Internet, go to the website address set forth on the enclosed proxy card and follow the instructions provided at the website.

•To vote by proxy over the telephone, dial the toll-free phone number listed on your proxy card under the heading “Vote by Phone” using a touch-tone phone and follow the recorded instructions.

If you vote by proxy, your vote must be received by 11:59 p.m. Eastern

Standard Time on Tuesday,

February 12, 2013,March 1, 2022, to be counted. If you are a stockholder of record and attend the Annual Meeting in person, you may vote in person at the Annual Meeting. We will give you a ballot when you arrive and any previous proxy that you submitted, whether by mail, Internet or telephone, will be superseded by the vote that you cast in person at the Annual Meeting. If you have any questions regarding how to submit your proxy or vote your shares at the Annual Meeting, please call our Corporate Secretary at

(858) 309-1700.(619) 269-6800.

We provide Internet and telephone proxy voting with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet and telephone access, such as usage charges from Internet access providers and telephone companies.

Beneficial Owner: Shares Registered in the Name of Your Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Mitek.the Company. To ensure that your vote

is counted, simply complete, sign, date and mail the proxy card or, if provided by your agent, follow the instructions for submitting your proxy through the Internet or by telephone. To vote in person at the Annual Meeting, you must obtain a proxy card issued in your name from your broker, bank or other agent in whose name the shares are registered prior to the Annual Meeting. Follow the instructions from your broker, bank or other agent included with these proxy materials or contact your broker, bank or other agent to request a proxy card.

Who is paying for this proxy solicitation?

We will pay the expenses of soliciting proxies for the Annual Meeting, including the cost of preparing, assembling and mailing the proxy materials. Proxies may be solicited personally, by mail, by telephone,

by facsimile or by

facsimileelectronic mail by our directors, officers or other employees. Our directors, officers or other employees will not receive additional compensation for soliciting proxies. We may request that any person holding stock in their name for the benefit of others, such as a broker, bank or other agent, forward the proxy materials to such beneficial owners and request authority to execute the proxy. We will reimburse any such broker, bank or other agent for their expenses in connection therewith.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign, date and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You may change your vote with respect to any proposal by revoking your proxy at any time prior to the commencement of voting with respect to such proposal at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy in any one of three ways:

•You may submit another properly completed proxy with a later date by mail, through the Internet or by telephone (your latest Internet or telephone instructions submitted prior to the deadline will be followed);

-3-

•You may send a written notice that you are revoking your proxy to our Corporate Secretary at Mitek Systems, Inc., 8911 Balboa Ave.,600 B Street, Suite B,100, San Diego, California 92123,92101, Attn: Corporate Secretary by no later than the close of business on Tuesday, February 12, 2013;March 1, 2022; or

•You may attend the Annual Meeting and vote in person. However, simply attending the Annual Meeting will not, by itself, revoke your proxy.

If your shares are held of record by a broker, bank or other agent, you must contact such record holder to revoke any prior voting instructions or obtain a proxy card issued in your name from such record holder in order to vote in person at the Annual Meeting. Following the commencement of voting with respect to a proposal, you may not revoke your proxy or otherwise change your vote with respect to such proposal.

Votes will be counted by the inspector of elections appointed for the Annual Meeting.

How are my shares voted if I give no specific instruction?

We must vote your shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally to vote the shares, they will be voted as follows:

•“For” each of the seveneight nominees for director named in this Proxy Statement;

•“For” the approval of anthe amendment to our restated certificatethe Restated Certificate of incorporationIncorporation to increase the number of authorized shares of common stock from 40,000,00060,000,000 to 60,000,000; and

120,000,000;•“For” the ratification of the selection of Mayer Hoffman as our independent registered public accounting firm for the fiscal year ending September 30, 2013.

2022; and•“For” the approval, on an advisory (non-binding) basis, of the compensation paid to our named executive officers as presented in this Proxy Statement.

This general authorization would exist, for example, if a stockholder of record merely signs, dates and returns the proxy card but does not indicate how its shares are to be voted on one or more proposals. If other matters properly come before the Annual Meeting, or any adjournment or postponement thereof, and you do not provide specific voting instructions, your shares will be voted as recommended by the Board.

If your shares are held of record by a broker, bank or other agent, see “What is a broker non-vote?” below regarding the ability of brokers, banks and other such holders of record to vote the uninstructed shares of their clients or other beneficial owners in their discretion and for an explanation of broker non-votes.

What is a broker non-vote?

Under rules that govern brokers, banks and other agents that are record holders of company stock held in brokerage accounts for their clients who beneficially own the shares, such record holders who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters (“(“discretionary matters”), but do not have discretion to vote uninstructed shares as to certain other matters (“(“non-discretionary matters”). Accordingly, a broker may submit a proxy card on behalf of a beneficial owner from whom the broker has not received voting instructions that casts a vote with regard to discretionary matters but expressly states that the broker is not voting as to non-discretionary matters. The broker’s inability to vote on non-discretionary matters with respect to which the broker has not received voting instructions from the beneficial owner is referred to as a “broker non-vote.” What are the voting requirements that apply to the proposals discussed in this Proxy Statement?

The election of directors contemplated by Proposal No. 1 will be decided by a plurality of the votes cast. Accordingly, the

seveneight director nominees receiving the highest number of votes will be elected. The approval of

-4-

an the amendment to our restated certificateRestated Certificate of incorporationIncorporation to increase the number of authorized shares of common stock from 40,000,00060,000,000 to 60,000,000120,000,000 contemplated by Proposal No. 2 requires the affirmative vote of the holders of a majority of the shares of common stock outstanding and entitled to vote either in person or by proxy at the Annual Meeting. The ratification of the selection of Mayer Hoffman as our independent registered public accounting firm for the fiscal year ending September 30, 2013 contemplated by Proposal No. 3 requiresand the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers contemplated by Proposal No. 4 each require the affirmative vote of the holders of a majority of the shares of common stock present and entitled to vote either in person or by proxy at the Annual Meeting.

What is the effect of withhold authority votes, abstentions and broker non-votes?

Withhold Authority Votes: Shares subject to instructions to withhold authority to vote on the election of directors will not be voted. This will have no effect on Proposa1Proposal No. 1—Election of Directors because, under plurality voting rules, the seveneight director nominees receiving the highest number of “for” votes will be elected. Abstentions: Under Delaware law (under which Mitek is incorporated), abstentions are counted as shares present and entitled to vote at the Annual Meeting. Therefore, abstentions will have the same effect as a vote “against”:, Proposal No. 2—Approval2 —approval of the Amendmentamendment to ourthe Restated Certificate of Incorporation andto increase the number of authorized shares of common stock from 60,000,000 to 120,000,000, Proposal No. 3—Ratification of the Selection of our Independent Registered Public Accounting Firm.Firm and Proposal No. 4—Approval, on an Advisory (Non-Binding) Basis, of the Compensation Paid to our Named Executive Officers. However, abstentions will have no effect on Proposa1Proposal No. 1—Election of Directors because under the plurality voting rules, the seveneight director nominees receiving the highest number of “for” votes will be elected. Broker Non-Votes: As a result of a change in the rules related to discretionary voting and broker non-votes, brokers,Brokers, banks and other agents are no longernot permitted to vote the uninstructed shares of their clients on a discretionary basis in the election of directors. Because broker non-votes are not considered under Delaware law to be entitled to vote at the Annual Meeting with respect to “non-discretionary” matters, they will have no effect on the outcome of the vote on: Proposa1on Proposal No. 1—Election of Directors. As a result, if you hold your shares in street name and you do not instruct your broker, bank or other agent how to vote your shares on Proposa1 No. 1—Election of Directors, no votes will be cast on your behalf on this proposal. Therefore, it is critical that you instruct your broker, bank or other agent how to vote on this proposal if you want your vote to be counted. Proposal No. 2—Approval2 —approval of the Amendmentamendment to ourthe Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 60,000,000 to 120,000,000 and Proposal No. 3—Ratification of Independent Registered Public Accounting Firm should be considered routine or “discretionary” matters on which your broker, bank or other agent will be able to vote on your behalf even if it does not receive instructions from you and, therefore, no broker non-votes are expected to exist in connection with Proposal No. 2 and Proposal No. 3. Proposal No. 4—Approval, on an Advisory (Non-Binding) Basis, of the Compensation Paid to our Named Executive Officers, is considered a “non-discretionary” matter on which your broker, bank or other agent will not be able to vote on your behalf if it does not receive instructions from you and, therefore, there may be broker non-votes on Proposal No 4. If you hold your shares in street name and you do not instruct your broker, bank or other agent how to vote your shares on Proposal Nos. 1 and 4, no votes will be cast on your behalf on these proposals. Therefore, it is important that you indicate your vote on these proposals if you want your vote to be counted.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the shares of our common stock outstanding on the record date are present either in person or by proxy at the Annual Meeting. At the close of business on January

3, 2013,12, 2022, the record date for the Annual Meeting, there were

26,041,28344,235,734 shares of common stock outstanding. Thus, a total of

26,041,28344,235,734 shares are entitled to vote at the Annual Meeting and holders of common stock representing at least

13,020,64222,117,868 votes must be represented at the Annual Meeting either in person or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or if one is submitted on your behalf by your broker, bank or other agent) or if you vote in person at the Annual Meeting. Votes withheld from a director nominee and abstentions will be counted as present for purposes of establishing the required quorum. Broker non-votes will be counted as present for purposes of establishing the required quorum. If there is no quorum, the chairman of the meeting or a majority of the shares present in person or by proxy at the Annual Meeting may adjourn the Annual Meeting to another date.

-5-

I

have also

have received a copy of the Company’s Annual Report on Form 10-K. Is that a part of the proxy materials?

Our Annual Report on Form 10-K for the fiscal year ended September 30, 2012 (the“Form 10-K”), as2021, filed with the Securities and Exchange Commission (the“SEC”) on December 7, 2012,13, 2021, accompanies this Proxy Statement. This document constitutes our Annual Report to Stockholders and is being made available to all stockholders entitled to receive notice of and to vote at the Annual Meeting. Except as otherwise stated, the Form 10-K is not incorporated into, and is not part of, this Proxy Statement and should not be considered proxy solicitation material. How can I find out the results of the voting at the Annual Meeting?

Voting results are expected to be announced at the Annual Meeting and will also be disclosed in a Current Report on Form 8-K (the“Current Report on Form 8-K”) that we will file with the SEC within four business days of the date of the Annual Meeting. In the event the results disclosed in ourthe Current Report on Form 8-K are preliminary, we will subsequently amend the Current Report on Form 8-K to report the final voting results within four business days of the date that such results are known. When are stockholder proposals due for next year’s annual meeting of stockholders?

Stockholders may submit proposals regarding matters appropriate for stockholder action for consideration at our next annual meeting of stockholders consistent with Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the“Exchange Act”), and our second amended and restated bylaws (the “Bylaws”). To be considered for inclusion in the proxy materials for our 20142023 annual meeting of stockholders, a stockholder proposal, including a proposal for the nomination of directors, must be submitted in writing no later than September 20, 2013October 3, 2022 to our Corporate Secretary at Mitek Systems, Inc., 8911 Balboa Ave.,600 B Street, Suite B,100, San Diego, California 92123,92101, Attn: Corporate Secretary. If you wishPursuant to the terms of our Bylaws, stockholders wishing to submit a proposalproposals or director nominations, including those that isare not to be included in theour 2023 proxy materials for our 2014 annual meeting of stockholders, your proposal generallystatement and proxy, must be submittedprovide timely notice in writing to the same address noour Secretary. To be timely, a stockholder’s notice must be delivered to or mailed and received at our principal executive offices not later than the close of business on December 4, 2013.2, 2022, nor earlier than November 2, 2022, subject to certain exceptions. Stockholders are advised to review our Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.-6-

Pursuant to our

amended and restated bylaws,Bylaws, the Board

currently has fixed the number of authorized directors at

seven.eight. The

seveneight director nominees receiving the highest number of votes at the Annual Meeting will be elected to the Board, to serve until our next annual meeting of stockholders and until their successors have been duly elected and qualified.

Unless authorization to do so is withheld, it is intended that the persons named in the enclosed proxythis Proxy Statement will vote for the election of the seveneight director nominees proposed by the Board. All incumbentproposed directors have been recommended by the Nominating and Corporate Governance Committee of the Board (the“Nominating Committee”) as nominees for re-election to the Board.. If any of the director nominees should become unavailable for election prior to the Annual Meeting, the proxy will be voted for a substitute nominee or nominees, if any, designated by the Board.

Specific Skills and Attributes to Be Represented on the Board

In consultation with our outside advisors, we have undertaken a review of the skills and attributes most critical for our Board of Directors to possess and evaluated each member of our current Board based on these qualities.

The areas in which each Board member is most equipped to provide leadership are noted in their individual biographies. It is important to note that not every Board member needs to be a leader in every area, nor does leadership in a larger number of areas make a Board member “better”; it is only critical that each quality is represented on our Board.

| | | | | |

| Skills and Attributes | Importance to Mitek |

| Industry knowledge | Mitek benefits from significant trends across several sectors including financial services, e-commerce, mobile, cellular, identity solutions and technology. Relevant industry expertise helps identify areas for growth or improvement as well as to craft the best business responses to market conditions. |

| Product marketing & sales | Mitek operates in competitive sectors and seeks to quickly launch and grow market share across its products. Product and marketing expertise helps in bringing new products to market & creating new markets as well as organizational design & delivery to achieve high revenue growth. |

| Strategic planning | Mitek operates in a highly dynamic field. Board members who have experience making strategic decisions for companies of various sizes, in various industries and at various stages in their development aid our continued high performance. |

| Technology leadership | The specific nature of Mitek’s businesses makes the ability to assess its technological competitiveness crucial. |

| Operational excellence | Strong management and a commitment to high performance are critical to maintaining and growing Mitek’s competitive position. |

| Human resources, compensation and succession planning | Mitek’s competitiveness depends on its ability to recruit and retain top-tier talent and to plan for its long-term needs. |

| Investor relations and fund-raising ability | The ability to explain Mitek’s story to the market is critical to maximizing stockholder value and ensuring the company has adequate access to capital. |

| Financial expertise | An understanding of Mitek’s financial position and outlook is essential to making informed strategic decisions for the Company. |

| Corporate governance leadership | Expertise in corporate governance supports assessment of the effectiveness of Mitek’s Board and proposing any necessary changes. |

| Mergers & acquisitions (M&A) experience | Ability to evaluate M&A opportunities is essential to delivering stockholder value. |

| | | | | |

| Skills and Attributes | Importance to Mitek |

| Diverse perspective | Diversity in perspective, background and experience is critical to our ability to serve our customers, identify opportunities and address problems. A demonstrated commitment to diversity of backgrounds and experiences is crucial to our ability to attract and retain talent. |

| Global experience | Success in our industry requires constant expansion to new markets, and our Board members need to be equipped to evaluate the state of our business in global markets. |

The following table includes the names and certain information about the nominees for director. All of the nominees named below have consented to being named herein and to serve on the Board, if elected. | | | | | | | | | | | | | | |

Name | | Age | | Position |

John M. Thornton

Scipio “Max” Carnecchia | | 8058 | | Chief Executive Officer and Director |

| Scott Carter(4) | | 52 | | Director |

| Rahul Gupta(4) | | 62 | | Director |

| James C. “Jim” Hale(1)(2) | | 69 | | Director |

| Bruce Hansen (1)(3) | | 62 | | Chairman of the Board |

James B. DeBello

| | 54 | | President, Chief Executive Officer & Secretary and Director |

Vinton P. Cunningham(1)

Susan J. Repo(1) | | 7654 | | Director |

Gerald I. Farmer, Ph.D.(1) Kimberly S. Stevenson(1)(2) (3)

| | 7859 | | Director |

Bruce E. Hansen(1) (2)

Donna C. Wells(2)(3) | | 5360 | | Director |

Alex W. “Pete” Hart(2) (3)

| | 72 | | Director |

Sally B. Thornton

| | 78 | | Director |

(1) | Member of the Audit Committee of the Board |

(2) | Member of the Compensation Committee of the Board |

(3) | Member of the Nominating and Corporate Governance Committee of the Board |

John M. Thornton. (1)Member of the Audit Committee of the Board (the “Audit Committee”)

(2)Member of the Compensation Committee of the Board (the “Compensation Committee”)

(3)Member of the Nominating Committee

(4)Mr. ThorntonCarter and Mr. Gupta were recommended by the Nominating Committee.

Scipio “Max” Carnecchia. Mr. Carnecchia has served as the Chief Executive Officer and as a director of Mitek since March 1986 and as our Chairman sinceNovember 2018. From October 1987. He also2017 until July 2018, Mr. Carnecchia served as ourthe Chief Executive Officer and board member of Illuminate Education, Inc., the market-leading software as a services education platform. Prior to Illuminate, Mr. Carnecchia was the President and Chief Executive Officer of Accelrys, Inc., and has also served on the Accelrys board from 2009 until its acquisition in 2014 by Dassault Systemes. After the acquisition, Mr. Carnecchia continued to service as Chief FinancialExecutive Officer from September 1998 to May 2003, when he resigned from his positionsof that business, which was renamed BIOVIA. Mr. Carnecchia previously served as President and Chief Executive Officer. He resigned from his position as Chief Financial Officer in May 2005. From May 1991 to February 1992, Mr. Thornton served as our President and from May 1991 to July 1991, he served as our Chief Executive Officer. From 1976 through 1988, Mr. Thornton served as Chairman and Vice Chairman of the Board at Micom Systems, Inc. Mr. Thornton is also Chairman of the Board of Thornton Winery Corporation in Temecula, California. Mr. Thornton is married to Sally B. Thornton, a member of our Board. Mr. Thornton holds an A.B. in economics from Pomona College and an MBA from Harvard Business School. As a director since the Company’s formation in 1986 and having previously served as our President,Interim Chief Executive Officer of Interwoven, Inc., a content management software company, which was acquired by Autonomy Corporation plc in January 2009. Prior to joining Interwoven; Mr. Carnecchia served as Vice President of Global Sales of Xoriant Corporation, a software product development company, from April 2000 to January 2001, and as Vice President of Sales and Services of SmartDB Corporation, a provider of data integration toolkits for systems integrators and IT organizations, from September 1996 to February 2000. Mr. Carnecchia has demonstrated significant leadership skills in his Chief FinancialExecutive Officer roles at Accelrys, Interwoven, BIOVIA and Illuminate Education, Inc. and as Vice President of Xoriant and SmartDB, and brings more than two decades of high technology experience to his position on the Board. During the past five years, Mr. Thornton has in-depth knowledge of our company and the industries in which we sell our products. Mr. Thornton also brings to the Board his extensive executive management and chairman experience with public and privately held companies, which the Board believes provides him with the skills necessary to serve as our Chairman.James B. DeBello. Mr. DeBelloCarnecchia has served as a director since November 1994, as our President and Chief Executive Officer since May 2003 and as our Secretary since January 2009. From January 2009 to September 2011, Mr. DeBello also served as our Chief Financial Officer in addition to his other positions. Prior

-7-

to joining Mitek, he was Chief Executive Officer of AsiaCorp Communications, Inc., a wireless data infrastructure and software company, from July 2001 to May 2003. He was Venture Chief Executive Officer for IdeaEdge Ventures, Inc., a venture capital company, from June 2000 to June 2001. From May 1999 to May 2000, he was President, Chief Operating Officer and a member of the boardboards of directors of CollegeClub.com, an Internet company. From November 1998 to April 1999, he was Chief Operating Officer of WirelessKnowledge,of: Guidance Software, Inc., a joint venture company formed between MicrosoftAgilysys, Inc., Accelrys, Inc., and Qualcomm,DHI, Inc. From November 1996 to November 1998, Mr. DeBello held positions as Vice President, Assistant General Manager and General Manager of Qualcomm, Inc.’s Eudora Internet Software Division, and Vice President of Product Management of Qualcomm, Inc.’s Subscriber Equipment Division. Mr. DeBelloCarnecchia holds a B.A., magna cum laude,Bachelor of Engineering in Electrical Engineering from Harvard University and an MBA from Harvard Graduate SchoolStevens Institute of Business, and he was a Rotary Scholar at the University of Singapore where he studied economics and Chinese.Technology. Mr. DeBello has over 15 years of experience in various senior executive positions, including chief executive officer, at other global technology companies. As a directorCarnecchia’s extensive knowledge of the Company for approximately 18 years andindustry in which we operate, as well as his unique role in the day-to-day operations of the Company as our President and Chief Executive Officer since 2003, Mr. DeBello has gained extensive knowledge of the industries in which we operate, allowingallows him to bring to the Board a broad understanding of the operational issues and strategic opportunitiesissues facing the Company.

Vinton P. Cunningham

Skills and attributes: Industry knowledge; product marketing and sales; strategic planning; technology leadership;

operational excellence; human resources; investor relations and fundraising ability; M&A experience; global experience

Scott Carter. Scott Carter is a director nominee and has served as a special advisor to our CEO and Board of Directors sharing his industry knowledge and assisting with product and market strategy since December 2020. From September 2014 to July 2018 he served as the Chief Executive Officer and previously Chief Operating Officer of ID Analytics, now LexisNexis, a provider of risk management solutions offering credit risk, consumer protection, risk identification, fraud detection, payment, and theft protection services. Since July 2021, Mr. Carter has also been an operating partner with Bryce Catalyst, an investment company with a focus on high growth sectors in cyber security, legal technology, and regulation technology. From May 2019 until December 2020, Mr. Carter served as the Chief Operating Officer and Advisor of Brain Corp, an artificial intelligence company which creates transformative core technology for the robotics industry. Mr. Carter previously served as our Chief Marketing Officer from July 2013 until September 2014. From January 2005 to June 2013, Mr. Carter served as Senior Vice President with Experian Decision Analytics, a consumer credit reporting company which sells decision analytic and marketing assistance to businesses. Mr. Carter is a member of the boards of directors of: Guardinex, Inc., Vital4, and LendingUSA. Mr. Carter has also advised various private equity firms on prospective

acquisitions of SaaS, FinTech and data and AI enabled companies. Mr. Carter also served as the Chairman of the Board of Ubi Security, Inc. from July of 2018 through June of 2019. Mr. Carter earned a Bachelor of Arts from the University of Delaware and a Masters in Business Administration from the University of Delaware, Lerner College of Business. In addition he has completed further executive education at the Kellogg School at Northwestern University. Mr. Carter is a seasoned executive with a diverse range of experiences as a technology business leader, advisor and board member. Having held C-level positions for leading solution providers and previously in client-side industry roles, Mr. Carter has a uniquely 360-degree view and has a consistent track record of accelerating growth for organizations, utilizing client and market insight to inform strategy, corporate development product, technology, sales and marketing activities.

Skills and attributes: Industry knowledge, product marketing & sales, strategic planning, technology leadership, operational excellence, human resources, compensation and succession planning, financial expertise, and corporate governance leadership, and global experience.

Rahul Gupta. Rahul Gupta is a director nominee. From January 2017 to March 2019, Mr. Gupta served as CEO of RevSpring, a high-growth technology services organization that provides intelligent financial engagement and payment solutions to 2,000 leading healthcare providers. Mr. Gupta also previously served as Group President, Billing and Payments at Fiserv, from November 2014 to December 2016, and as Group President, Digital Payments, at Fiserv from December 2006 to November 2014. Mr. Gupta is a current board member at Amount, Exact Payments, SavvyMoney, and Capital Good Fund and a former board member after successful exits at Cardtronics (CATM), Zego/PayLease, and nContracts. Additionally, he is an advisor at NYCA, a venture capital fund, the following private equity funds: Platform Partners, Water Street, and StoicLane, as well as several fintech companies. He is an Ambassador for the University of Southern California (“USC", a member of USC Provost Associates, and a mentor to multiple startup teams at the Viterbi School of Engineering. Mr. Gupta graduated Magna Cum Laude with a Masters of Business Administration from Indiana University and holds a Bachelor of Arts in Commerce from Delhi University as well as a CPA certification from India. Mr. Gupta is well qualified to serve on our Board of Directors due to his over 35 years of experience in the financial services and fintech industries having served in a variety of capacities at the board and executive levels.

Skills and attributes: Industry knowledge, product marketing & sales, strategic planning, technology leadership, investor relations and fund-raising, financial expertise, M&A experience, and global experience.

James C. Hale. Mr. CunninghamHale has served as a director since May 2005. HeNovember 2014. Prior to joining the Board, Mr. Hale served on our advisory board from September 2012 until November 2014. Mr. Hale has launched and grown multiple businesses that leveraged his vision of the evolving financial services marketplace, knowledge of emerging financial technologies, and global network at top financial service companies built over several decades in commercial and investment banking. Since 2011, Mr. Hale has been advising growth companies as a consultant at Columbus Strategic Advisors, LLC, a firm he co-founded. In 1998, Mr. Hale co-founded and served as Senior Vice President Finance of EdVision Corporation, a provider of curriculum development and assessment tools for the education community, from 1993 until his retirement in 2002. Mr. Cunningham was Chief Operating OfficerManaging Member and Chief FinancialExecutive Officer of Founders Club Golf Company,Financial Technology Ventures, now FTV Capital, an investment firm specializing in venture capital and private growth equity investments in financial technology companies worldwide, where he is currently a golf equipment manufacturer, from 1990Partner Emeritus. From 1982 to 1993. He1998, Mr. Hale was Vice President Finance of Amcor Capital, Inc., a company that organizedwith BancAmerica Securities (formerly Montgomery Securities) where he was the Senior Managing Partner and managed real estate syndications, from 1985 to 1990. Mr. Cunningham was Chief Financial Officer and Treasurer of Superior Farming Company, a wholly owned subsidiary of Superior Oil Company, an independent chemical supplier and fiberglass distributor, from 1981 to 1985. Mr. Cunningham holds a B.S. in accounting from the University of Southern California. The Board believes Mr. Cunningham’s financial background provides the Board with valuable financial and accounting expertise and makes him well suited to serve on the Audit CommitteeHead of the Board. Having served asFinancial Services Group, a director of the Company since 2005,practice that he founded. From 2015, Mr. Cunningham has a strong understanding of our business, operations and culture.Gerald I. Farmer. Dr. FarmerHale has served as a director since May 1994 and served as our Executive Vice President from November 1992 until June 1997. Prior to joining Mitek, from January 1987 to November 1992, Dr. Farmer was Executive Vice Presidentrisk committee chairman of HNC Software, Inc.ACI Worldwide (NASDAQ: ACIW), a global software company, and as a director of Visual Edge Technology, a national provider of enterprise analytic software.office technology solutions. From 2014, Mr. Hale has served as a director and audit committee chairman of Bank of Marin Bancorp (NASDAQ: BMRC), an independent commercial and retail bank in Northern California. Mr. Hale was a director of ExlService Holdings, Inc. (NASDAQ: EXLS), a business process outsourcing company, from 2001 to 2009 and a director and board chairman of Official Payments (NASDAQ: OPAY), a global electronic payments software company, from 2010 to 2014. In addition, he has held senior management positions with IBM Corporation, Xerox, SAICMr. Hale was a director of the State Bank of India (California), a California state chartered bank, and Gould Imaging and Graphics. Dr. FarmerPublic Radio International, a media company, among other private company boards. He holds a B.S.Bachelor of Science in chemistryFinance and Accounting from the University of WyomingCalifornia, Berkeley, an MBA from Harvard Business School, and an M.S. and Ph.D. in physics and mathematics from the University of Wisconsin, Madison. The Board believes Dr. Farmer’s extensive career asis a leader of several technology-based companies makes himCertified Public Accountant (inactive). Mr. Hale is well qualified to serve on our Board of Directors due to his 35 years of management experience in the Board. Having served the Companybanking, payments, financial services and technology industries, and expertise and experience as both an executive officera corporate director and a director since 1992, Dr. Farmer has a deep understandingboard chairman of both ourother public and private companies.

Skills and attributes: Industry knowledge; strategic planning; technology leadership; investor relations and the industries in which we operate.fundraising ability; financial expertise; corporate governance leadership; M&A experience; global experience

Bruce E. Hansen. Mr. Hansen has served as a director since October 2012, as our lead independent director from March 2016 until September 2018, and as our Chairman since September 2018. From August 2018 until the hiring of our new Chief Executive Officer in November 2018, Mr. Hansen served as our Principal Executive Officer. From October 2010 until October 2012 he served as a member of our advisory board from October 2010 to October 2012.board. In 2002, he co-foundedcofounded ID Analytics Inc., a consumer risk management company, and served as its Chairman and Chief Executive Officer from its inception until it was acquired by LifeLock, Inc. in March 2012. Prior to founding ID Analytics, he was President at HNC Software Inc., a global provider of analytic software solutions for financial services, telecommunications and healthcare firms, from 2000 to 2002. Mr. Hansen’s previous experience also includes the role of Chief

Executive Officer of the Center for Adaptive Systems Applications and executive roles at CitiCorp (now CitiGroup), Automatic Data Processing (ADP) and Chase Manhattan Bank (now JP Morgan Chase). He currently serves as Chairman of the Board at BrightScope, Inc. and as a member of the board of directors of Verisk Analytics, GDS Link, LLC, and RevSpring, Inc. Mr. Hansen previously served on the San Diego Venture Group.board of directors for Performant Financial Corporation, a provider of technology-enabled recovery and related analytics services, from April 2013 to July 2019. Mr. Hansen holds a B.A.Bachelor of Arts in economicsEconomics from Harvard University and an M.B.A.a Masters in Business Administration from the University of Chicago. As a proven leader with decades of analytics industry experience ranging from concept-stage companiesto established financial services companies, Mr. Hansen brings to the Board a unique perspective, and an expansive-8-

knowledge base and domain expertise in the fields of identity verification and big data systems. The Board believes that Mr. Hansen’s experience as both a key executive and director will enable him to contribute to the Board with respect to both general governance matters and industry-specific operations.

Alex W. “Pete” Hart. Mr. Hart

Skills and attributes: Industry knowledge; product marketing and sales, strategic planning; technology leadership; operational excellence; human resources, compensation and succession planning; investor relations and fundraising ability; financial expertise; corporate governance leadership; M&A experience; global experience

Susan J. Repo. Ms. Repo has served as a director since June 2021. Since February 2011. In April 2012, he retired as Chairman of the SVB Financial Group and2021 she has worked as an independent consultant in the financial services industry since 1997. He served as Chief ExecutiveFinancial Officer of Advanta Corporation,ICEYE, a public diversified financial services company, from 1995Finnish micro satellite manufacturer. From 2013 to 1997, where he had previously2018, Ms. Repo held various positions at Tesla, an electric vehicle manufacturer, most recently serving as Corporate Treasurer and Vice President Finance. From 2019 to 2020, Ms. Repo served as Executive Vice Chairman from 1994 to 1995. Prior to joining Advanta, he was President andthe Chief Operating Officer of MariaDB Corporation, an open source storage company. In 2019, Ms. Repo served as the Chief Executive Officer and Chief Operating Officer of MasterCardDriveOn, an automotive fintech company, and in 2018, Ms. Repo served as the Chief Financial Officer of Topia, a talent mobility platform. From 2007 to 2013, she served as Senior Director of International Tax at Juniper Networks, Inc., a worldwide payment service provider, from 1988 to 1994. Mr. Hartmultinational corporation that develops and markets networking products, including routers, switches, network management software, network security products, and software-defined networking technology. Ms. Repo currently serves as an advisor to a numberon the board of private companies, including NoLie MRI, Cimbal Technologies and US Encode. Mr. Hart is currentlydirectors of: GM Financial Bank, a member of the boardGeneral Motors subsidiaries, and Call2Recycle, Inc., the largest battery stewardship and recycling organization in North America, where she chairs the audit & technology committee. Ms. Repo holds a Bachelor of directorsScience in Business Administration and Finance from the University of Southern California and a JD from the Chicago-Kent College of Law, at the Illinois Institute of Technology University and a Masters of Law from Stanford Law School. The Board believes her diverse experiences in the technology industry make her well qualified to serve on the Board.

Skills and attributes: Financial expertise, corporate governance leadership, M&A experience, strategic planning, global experience, operational excellence, investor relations and fundraising abilities, human resources, compensation and succession planning, technology leadership, and diverse perspective.

Kimberly S. Stevenson. Ms. Stevenson has been a director since November 2020. She currently serves as senior vice president

and general manager of the following public companies: Global Payments,Foundational Data Services Business Unit at NetApp, Inc., a paymentpublicly traded provider of cloud data services. Previously, Ms. Stevenson served as senior vice president and general manager of data center products and solutions for Lenovo, a multinational technology company, from March 2017 to October 2018. From September 2009 to February 2017, she served as a corporate vice president at Intel Corporation, holding various positions including chief operating officer for the client and internet of things businesses and systems architecture group from September 2016 to February 2017, chief information officer from February 2012 to August 2016, and general manager, IT operations and services, company,from September 2009 to January 2012. Prior to joining Intel, Ms. Stevenson spent seven years at the former Electronic Data Systems, now DXC Technology, with responsibility for global development and VeriFone Holdings, Inc., an electronics company. He isdelivery of enterprise services. She also spent more than 17 years at IBM in various finance and operational roles. Ms. Stevenson currently serves as a director of Solicore,Boston Private Financial Holdings (Nasdaq: BPFH) a bank holding company, and Skyworks Solutions, Inc. (Nasdaq: SWKS), both publicly traded companies. She previously held board positions with Riverbed Technology, a privately held battery manufacturer. In additionpublicly traded hardware and software developer (prior to SVB Financial, Mr. Hart has also previously served asits being taken private in 2015), Cloudera, a member ofprivate enterprise software company, and the board of directors of the following companies: FICO, Inc., HNC Software, Inc., Retek Inc., Shopping.com, Sanchez Computer Associates, US Encode, eHarmony.comNational Center for Women and Sequal Technologies, Inc. Mr. HartInformation Technology, a non-profit organization. Ms. Stevenson holds a B.A.Bachelor of Science in social relationsAccounting and Business Management from Harvard University. AsNortheastern University and an experienced leader in theMBA from Cornell.

Skills and attributes: Industry knowledge; product marketing and sales; strategic planning; technology leadership; operational excellence; financial services industry, Mr. Hart combines extensive general business expertise with a deep knowledge of the financial services and payments industry. Hisexpertise; corporate governance leadership; diverse perspective; global experience on the boards of directors of other companies in the financial services industry further augments his range of knowledge, providing experience on which he can draw while serving as a member of the Board. Sally B. Thornton. Mrs. Thornton Donna C. Wells. Ms. Wellshas served as a director since April 1988. From 1987 until 1996,November 2019. Prior to joining our Board, she served on our advisory board from September 2017 until November 2019. Ms. Wells is a serial entrepreneur, an experienced board director, and an innovator in the financial services, FinTech and cloud software industries. She is currently CEO of Valencia Ventures, a private company that provides strategic consulting and corporate governance services. From 2010-2017, Ms. Wells served as ChairmanBoard Director, President and CEO of Medical Materials,Mindflash Technologies, Inc., an innovative venture-backed enterprise software startup that built a composite plastics manufacturer. Mrs. Thornton servedcorporate training platform for businesses. In that capacity, she led the company from SaaS product launch to market leadership and to recognition as a Top 50 Small US Company to Work for by Fortune. Prior to her role at Mindflash, Ms. Wells was CMO at Mint Software, Inc. from 2007-2009. There, she led the growth strategy for this breakthrough, mobile personal finance software company from product launch to the company’s acquisition by Intuit. Prior to Mint, Ms. Wells had a 20-year career in strategic marketing with The American

Express Company and The Charles Schwab Corporation and led marketing for two Fortune 500 companies, Intuit and the Expedia Group. She currently serves as a Board Member at Walker & Dunlop, a leading CRE Finance company, CWT Travel Holdings, Inc., one of the largest global business travel management companies worldwide, and the FinTech “Unicorn” Betterment. She was previously a director at Boston Private Financial Holdings, Inc, a bank holding company, from 2014 to 2018 and Apex Technology Acquisition Corporation, a special purpose acquisition company, from 2019 to 2021. In September 2019, Ms. Wells was appointed by the Center for Entrepreneurial Studies at the Stanford University Graduate School of Business as a Lecturer in Management. In September 2021, she was named Board Director of the Year by the Women in Information Technology organization. She holds an MBA from Stanford University and a Bachelor of Science in Economics from The Wharton School at the University of Pennsylvania. The Board believes Ms. Wells is well qualified to serve as a director due to her wealth of Micom Systems, Inc. from 1976 to 1988. She has also been a Trustee ofexperience in the Sjorgren’s Syndrome Foundation in New York. Mrs. Thornton is a Life Trustee of the San Diego Museum of Art, is on the board of directors of Thornton Winery Corporation in Temecula, CaliforniaFinTech and is the Chairman of the John M.cloud

software industries.

Skills and Sally B. Thornton Foundation. Mrs. Thornton is married to John M. Thornton, our Chairman. Mrs. Thornton holds an A.A. from Stephens Collegeattributes: Industry knowledge; product marketing and a B.A. and M.A. in history from the University of San Diego. As a director of the Company since 1988, Mrs. Thornton has in-depth knowledgesales;strategic planning; technology leadership; operational excellence; financial expertise; diverse perspective

None of our

company anddirectors or director nominees has any family relationships with any of our

technology. Mrs. Thornton also brings to the Board her extensive leadership experience as a director and trustee of both for-profit and non-profit organizations.other directors or executive officers. There currently are no legal proceedings, and during the past 10 years there have been no legal proceedings, that are material to the evaluation of the ability or integrity of any of our directors or director nominees.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION TO THE BOARD OF THE DIRECTOR NOMINEES DISCUSSED IN THIS PROPOSAL NO. 1.

-9-

APPROVAL OF AN AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM

40,000,00060,000,000 TO

60,000,00120,000,000

Our restated certificate of incorporation (the“Restated Certificate”) currently authorizes us to issue a total of 40,000,00060,000,000 shares of common stock and 1,000,000 shares of preferred stock. On December 26, 2012,January 6, 2022, the Board unanimously approved an amendment to the Restated Certificate to authorize an additional 20,000,00060,000,000 shares of common stock (the“Amendment”), subject to stockholder approval. The Board has unanimously determined that the Amendment is advisable and in the best interests of the Company and our stockholders, and, in accordance with the General Corporation Law of the State of Delaware, hereby seeks approval of the Amendment by our stockholders. The Board is proposing the Amendment, in substantially the form attached hereto asAppendix A, to increase the number of authorized shares of our common stock from 40,000,00060,000,000 shares to 60,000,000120,000,000 shares, which would in turn increase the total number of shares of all classes of Company capital stock from 41,000,00061,000,000 to 61,000,000.121,000,000. Of the 40,000,00060,000,000 shares of common stock currently authorized by the Restated Certificate 26,041,283and as of the Record Date, 44,235,734 shares of common stock are issued and outstanding, 4,501,9304,762,677 shares are reserved for issuance upon exercise of outstanding options and settlement of outstanding restricted stock units (“RSUs”) and warrants and 1,431,8572,327,745 shares are reserved for future issuance under existing equity incentive plans. Therefore, we are currently limited to the issuance of 8,024,9308,673,847 shares of common stock. There are no shares of preferred stock currently outstanding and no changes to the Restated Certificate are being proposed with respect to the number of authorized shares of preferred stock. Other than the proposed increase in the number of authorized shares of common stock, the Amendment is not intended to modify the rights of existing stockholders in any material respect.

Reasons for the Amendment

The Board believes the Amendment is advisable and in the best interests of the Company and our stockholders to make available for future issuance a sufficient number of authorized shares of common stock to (i) give us appropriate flexibility to issue shares for future corporate needs.needs and (ii) allow us to reserve sufficient shares for the potential settlement of the 2026 Convertible Notes (as defined below) and the related warrant transactions (the “

Warrant Transactions”) in shares of common stock. The additional authorized shares would provide us with increased financing and capital raising flexibility and could be used for other business and financial purposes that the Board deems are in the Company’s best interest, including the acquisition of other companies, businesses or products in exchange for common stock, attraction and retention of employees through the issuance of additional securities under our equity incentive plans, and implementation of stock splits and issuance of dividends in the future. Without an

increase in the number of authorized shares of common stock, the Company may be constrained in its ability to raise capital, should the need arise, and may lose important business opportunities, including to competitors, which could adversely affect our financial performance and growth.

The additional authorized shares of common stock would enable us to act quickly in response to capital raising and other corporate opportunities that may arise (as described above), in most cases without the necessity of holding a special stockholders’ meeting and obtaining further stockholder approval before the issuance of common stock could proceed, except as may be required by applicable law or the rules of The NASDAQ Stock Market, LLC (“NASDAQ”NASDAQ”) or any other stock exchange on which our securities may be listed.-10-

In addition to the flexibility afforded by the increase in authorized shares discussed above, the authorized share increase would also allow us to reserve shares for the potential settlement of the 2026 Convertible Notes in shares of common stock instead of cash. In February 2021, we issued $155.25 million aggregate principal amount of 0.75% convertible notes due 2026 (the “2026 Convertible Notes”) and concurrently entered into privately-negotiated convertible senior note hedge and Warrant Transactions. We agreed to settle conversions solely in cash in respect of any conversion of 2026 Convertible Notes unless and until we receive the approval of our stockholders to increase the number of authorized but unissued shares of our common stock that are not reserved for other purposes and reserve such amount of shares of our common stock for future issuance as required pursuant to the indenture that governs the 2026 Convertible Notes (the “Share Increase Approval”).

Under the Warrant Transactions, we have agreed to use our good faith and reasonable efforts to obtain the Share Increase Approval in order to increase the number of authorized shares of our common stock to an amount sufficient to deliver up to the maximum number of shares (as may be adjusted pursuant to the terms thereof) pursuant to the Warrant Transactions.

Other than issuances pursuant to equity incentive plans,

and currently outstanding warrants, as of the date of this Proxy Statement, we have no current plans, arrangements or understandings regarding the issuance of any additional shares of common stock that would be authorized pursuant to this proposal and there are no negotiations pending with respect to the issuance thereof for any purpose. However, we review and evaluate potential capital raising activities, transactions and other corporate opportunities on an ongoing basis to determine if any such actions would be in the best interests of the Company and our stockholders.

Rights of Additional Authorized Shares

The additional authorized shares of common stock, if and when issued, would be part of the existing class of common stock and would have the same rights and privileges as the shares of common stock currently outstanding. Stockholders do not have preemptive rights with respect to our common stock. Therefore, should the Board determine to issue additional shares of common stock, existing stockholders would not have any preferential rights to purchase such shares in order to maintain their proportionate ownership thereof.

Potential Effects of the Amendment

The increase in the number of authorized shares of common stock will not have any immediate effect on the rights of our existing stockholders. The Board will have the authority to issue the additional shares of common stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or NASDAQ Marketplace Rules or any other stock exchange on which our securities may be listed. The issuance of additional shares of common stock will decrease the relative percentage of equity ownership of our existing stockholders, thereby diluting the voting power of their common stock, and, depending on the price at which the additional shares are issued, may also be dilutive to the earnings per share of our common stock.

Although we have no immediate plans to do so, we could use the additional authorized shares of common stock for potential strategic transactions, including, among other things, acquisitions, strategic partnerships, joint ventures, restructurings, divestitures, business combinations and investments. We cannot provide assurances that any such transactions would be consummated on favorable terms or at all, that they would enhance stockholder value or that they would not adversely affect our business or the trading price of our common stock. Any such transactions may require us to incur non-recurring or other charges and may pose significant integration challenges and/or management and business disruptions, any of which could materially and adversely affect our business and financial results.

The authorization of additional shares of common stock could also have an anti-takeover effect, in that the additional shares could be issued to oppose a hostile takeover attempt or delay or prevent changes in control or management of the Company. For example, without further stockholder approval, the Board could sell shares of our common stock in a private transaction to purchasers who would oppose a takeover attempt or favor our current Board. Although this proposal to increase the number of authorized shares of common stock has been prompted by business and financial considerations and not by any current or threatened hostile takeover attempt, stockholders should be aware that approval of this proposal could facilitate future attempts by the Company to oppose changes in control of the Company and to perpetuate our then-current management, including the opposition of transactions in which the stockholders might otherwise receive a premium for their shares over then-current market prices.

Effectiveness of the Amendment and Required Vote

If the Amendment is approved by our stockholders, the Amendment will become effective upon the filing of a certificate of amendment with the Delaware Secretary of State, which filing is expected to occur promptly after the Annual Meeting. If the Amendment is not approved by our stockholders, the Restated Certificate will not be amended and the number of authorized shares of common stock will remain unchanged.

-11-

The affirmative vote of the holders of a majority of the shares of

our common stock issued and outstanding and entitled to vote at the Annual Meeting is required to approve the Amendment. As a result, abstentions will have the effect of a vote “AGAINST” this proposal.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE AMENDMENT TO THE RESTATED CERTIFICATE TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 40,000,00060,000,000 TO 60,000,000.120,000,000.

RATIFICATION OF THE SELECTION OF OUR

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee

of the Board (the“Audit Committee”) has selected the firm of Mayer Hoffman,

McCann P.C., independent certified public accountants, to serve as our independent registered public accounting firm for the fiscal year ending September 30,

2013.2022. Representatives of Mayer Hoffman are expected to be present at the Annual Meeting and will have the opportunity to make a statement and respond to appropriate questions.

Substantially all of Mayer Hoffman’s personnel, who work under the control of Mayer Hoffman shareholders, are employees of wholly-owned subsidiaries of CBIZ, Inc., which provides personnel and various services to Mayer Hoffman in an alternative practice structure.

Neither our governing documents nor applicable laws require stockholder ratification of the selection of Mayer Hoffman as our independent registered public accounting firm. However, the Board is submitting the selection of Mayer Hoffman to our stockholders for ratification as a matter of good corporate governance. If our stockholders fail to ratify the selection of Mayer Hoffman, the Audit Committee will reconsider whether or not to retain Mayer Hoffman. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

Independent Registered Public Accounting Firm Fee Information

The following table sets forth the aggregate fees billed by Mayer Hoffman for the services indicated for the fiscal years ended September 30,

20122021 and

2011: | | | | | | | | |

| | | Fiscal Year Ended

September 30,

2012 | | | Fiscal Year Ended

September 30,

2011 | |

Audit Fees (1) | | $ | 167,300 | | | $ | 147,000 | |

Audit-Related Fees | | | — | | | | — | |

Tax Fees | | | — | | | | — | |

All Other Fees | | | — | | | | — | |

| | | | | | | | |

Total Fees | | $ | 167,300 | | | $ | 147,000 | |

(1) | Includes fees for: (i) the audit of our annual financial statements for the fiscal years ended September 30, 2012 and 2011 included in our annual reports on Form 10-K; (ii) the audit of our internal control over financial reporting for the fiscal year ended September 30, 2012; (iii) the review of our interim period financial statements for the fiscal years ended September 30, 2012 and 2011 included in our quarterly reports on Form 10-Q; and (iv) related services that are normally provided in connection with regulatory filings or engagements. |

2020. All fees described below were approved by the Audit Committee.

| | | | | | | | | | | |

| | Fiscal Year Ended September 30, 2021 | | Fiscal Year Ended September 30, 2020 |

| Audit Fees(1) | $ | 1,147,893 | | | $ | 609,213 | |

| Audit-Related Fees(2) | 56,325 | | | 75,528 | |

| Tax Fees | — | | | — | |

| All Other Fees | — | | | — | |

| Total Fees | $ | 1,204,218 | | | $ | 684,741 | |

(1)This category represents fees paid to Mayer Hoffman for (i) the audit of our annual financial statements for the fiscal years ended September 30, 2021 and 2020 included in our annual reports on Form 10-K; (ii) the review of our unaudited interim period financial statements for the fiscal years ended September 30, 2021 and 2020 included in our quarterly reports on Form 10-Q; (iii) the audit of our internal control over financial reporting for the fiscal year ended September 30, 2021; and (iv) the services that are normally provided by Mayer Hoffman in connection with statutory and regulatory filings or engagements.

(2)This category represents fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under Audit Fees. This category includes fees related to audit and attest services not required by statute or regulations, due diligence related to mergers, acquisitions and investments and consultations concerning financial accounting and reporting standards.

The Audit Committee has established policies and procedures by which it approves in advance any audit and permissible non-audit services to be provided by our independent registered public accounting firm. Under these policies and procedures, prior to the engagement of the independent registered public accounting firm for pre-approved services, requests or applications for the independent registered public accounting firm to provide services must be submitted to the Audit Committee and must include a detailed description of the services to be rendered. Our

chief financial officerChief Financial Officer and the independent registered public accounting firm must ensure that the independent registered public accounting firm is not engaged to perform the proposed services unless those services are within the list of services that have received the Audit Committee’s pre-approval, and must cause the Audit Committee to be informed in a timely manner of all services rendered by the independent registered public accounting firm and the related fees.

-13-

Each request or application must include:

•a recommendation by our chief financial officerChief Financial Officer as to whether the Audit Committee should approve the request or application; and

•a joint statement of our chief financial officerChief Financial Officer and the independent registered public accounting firm as to whether, in their view, the request or application is consistent with the SEC’s requirements for auditor independence of the Public Company Accounting Oversight Board (the“PCAOB”).

The Audit Committee also will not permit the independent registered public accounting firm to be engaged to provide any services to the extent that the SEC has prohibited the provision of those services by an independent registered public accounting firm, which generally include:

•bookkeeping or other services related to accounting records or financial statements;

•financial information systems design and implementation;

| • | �� | appraisal or valuation services, fairness opinions or contribution-in-kind reports;

|

•appraisal or valuation services, fairness opinions or contribution-in-kind reports;

•actuarial services;

•internal audit outsourcing services;

•broker-dealer, investment adviser or investment banking services;

•expert services unrelated to the audit; and

•any service that the PCAOB determines is not permissible.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THIS PROPOSAL NO. 3 TO RATIFY THE SELECTION OF MAYER HOFFMAN TO SERVE AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2013.2022.

PROPOSAL NO. 4

APPROVAL, ON AN ADVISORY (NON-BINDING) BASIS, OF

THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS